Yes, Good symmetric triangle chart pattern Do Exist

Yes, Good symmetric triangle chart pattern Do Exist

Blog Article

Mastering Triangle Chart Patterns for Better Trading Methods

Article:

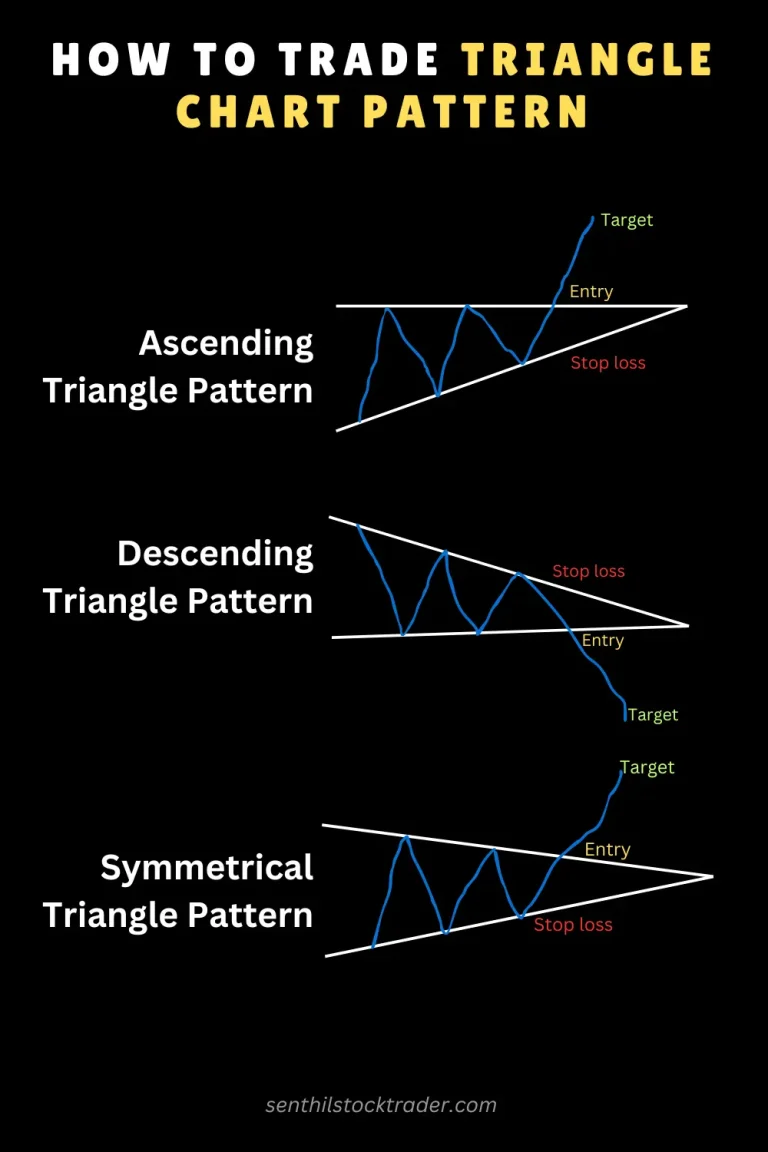

Triangle chart patterns are essential tools in technical analysis, supplying insights into market trends and prospective breakouts. Traders around the world count on these patterns to predict market movements, particularly throughout debt consolidation phases. One of the key reasons triangle chart patterns are so commonly utilized is their capability to show both extension and turnaround of trends. Understanding the intricacies of these patterns can help traders make more informed decisions and enhance their trading techniques.

The triangle chart pattern is formed when the price of a stock or asset changes within assembling trendlines, forming a shape looking like a triangle. There are numerous kinds of triangle patterns, each with unique characteristics, offering different insights into the potential future price movement. Among the most common types of triangle chart patterns are the symmetrical triangle chart pattern, the ascending triangle chart pattern, the descending triangle chart pattern, and the expanding triangle chart pattern. Traders also pay close attention to the breakout that occurs once the price moves beyond the triangle's boundaries.

Symmetrical Triangle Chart Pattern

The symmetrical triangle chart pattern is one of the most frequently observed patterns in technical analysis. It occurs when the price of an asset moves into a series of greater lows and lower highs, with both trendlines assembling towards a point. The symmetrical triangle represents a duration of debt consolidation, where the marketplace experiences indecision, and neither purchasers nor sellers have the upper hand. This period of balance often precedes a breakout, which can happen in either direction, making it crucial for traders to stay alert.

A symmetrical triangle chart pattern does not supply a clear sign of the breakout direction, indicating it can be either bullish or bearish. Nevertheless, numerous traders use other technical indicators, such as volume and momentum oscillators, to figure out the most likely direction of the breakout. A breakout in either direction indicates the end of the consolidation stage and the start of a new trend. When the breakout happens, traders typically anticipate considerable price movements, providing financially rewarding trading chances.

Ascending Triangle Chart Pattern

The ascending triangle chart pattern is a bullish formation, signifying that purchasers are gaining control of the marketplace. This pattern occurs when the price develops a horizontal resistance level, while the lows move upward, developing an upward-sloping trendline. The key feature of an ascending triangle is that the resistance level remains consistent, but the increasing trendline recommends increasing buying pressure.

As the pattern establishes, traders expect a breakout above the resistance level, signaling the extension of a bullish trend. The ascending triangle chart pattern often appears in uptrends, enhancing the idea of market strength. Nevertheless, like all chart patterns, the breakout should be confirmed with volume, as a lack of volume throughout the breakout can indicate a false move. Traders likewise use this pattern to set target prices based on the height of the triangle, including another dimension to its predictive power.

Descending Triangle Chart Pattern

In contrast to the ascending triangle, the descending triangle chart pattern is usually viewed as a bearish signal. This development happens when the price develops a horizontal support level, while the highs move downward, forming a downward-sloping trendline. The descending triangle pattern shows that selling pressure is increasing, while purchasers struggle to keep the support level.

The descending triangle is frequently found throughout downtrends, showing that the bearish momentum is likely to continue. Traders frequently expect a breakdown listed below the assistance level, which can result in substantial price declines. Similar to other triangle chart patterns, volume plays a crucial function in confirming the breakout. A descending triangle breakout, combined with high volume, can signal a strong continuation of the sag, providing important insights for traders aiming to short the market.

Expanding Triangle Chart Pattern

The expanding triangle chart pattern, likewise known as an expanding development, differs from other triangle patterns in that the trendlines diverge instead of assembling. This pattern takes place when the price experiences higher highs and lower lows, producing a shape that looks like an expanding triangle. Unlike the symmetrical, ascending, or descending triangle patterns, the expanding triangle pattern suggests increasing volatility in the market.

This pattern can be either bullish or bearish, depending on the direction of the breakout. Nevertheless, the expanding triangle pattern is often seen as an indication of unpredictability in the market, as both purchasers and sellers battle for control. Traders who determine an expanding triangle might wish to wait for a verified breakout before making any substantial trading choices, inverted triangle chart pattern as the volatility associated with this pattern can result in unforeseeable price motions.

Inverted Triangle Chart Pattern

The inverted triangle chart pattern, likewise known as a reverse symmetrical triangle, is a variation of the symmetrical triangle. In this pattern, the price makes larger changes as time advances, forming trendlines that diverge. The inverted triangle pattern typically indicates increasing uncertainty in the market and can signal both bullish or bearish reversals, depending upon the breakout direction.

Comparable to the expanding triangle pattern, the inverted triangle recommends growing volatility. Traders need to utilize caution when trading this pattern, as the wide price swings can result in unexpected and remarkable market motions. Verifying the breakout direction is important when analyzing this pattern, and traders typically count on additional technical indicators for further confirmation.

Triangle Chart Pattern Breakout

The breakout is one of the most essential aspects of any triangle chart pattern. A breakout occurs when the price moves decisively beyond the limits of the triangle, indicating the end of the consolidation phase. The direction of the breakout determines whether the pattern is bullish or bearish. For instance, a breakout above the resistance level in an ascending triangle is a bullish signal, while a breakdown below the support level in a descending triangle is bearish.

Volume is a critical consider validating a breakout. High trading volume throughout the breakout shows strong market involvement, increasing the possibility that the breakout will result in a sustained price movement. Conversely, a breakout with low volume may be an incorrect signal, causing a possible turnaround. Traders ought to be prepared to act quickly once a breakout is validated, as the price motion following the breakout can be fast and considerable.

Bearish Symmetrical Triangle Chart Pattern

Although symmetrical triangle patterns are neutral by nature, they can also provide bearish signals when the breakout strikes the drawback. The bearish symmetrical triangle chart pattern occurs when the price combines within assembling trendlines, however the subsequent breakout relocations below the lower trendline. This signals that the sellers have gained control, and the price is likely to continue its downward trajectory.

Traders can take advantage of this bearish breakout by short-selling or using other strategies to benefit from falling prices. As with any triangle pattern, verifying the breakout with volume is important to prevent false signals. The bearish symmetrical triangle chart pattern is particularly beneficial for traders aiming to determine continuation patterns in sags.

Conclusion

Triangle chart patterns play a crucial function in technical analysis, supplying traders with vital insights into market trends, consolidation stages, and prospective breakouts. Whether bullish or bearish, these patterns offer a reliable method to anticipate future price motions, making them important for both novice and experienced traders. Comprehending the different kinds of triangle patterns-- symmetrical, ascending, descending, expanding, and inverted-- allows traders to develop more efficient trading strategies and make notified decisions.

The key to successfully utilizing triangle chart patterns depends on acknowledging the breakout direction and verifying it with volume. By mastering these patterns, traders can enhance their ability to anticipate market movements and profit from rewarding chances in both rising and falling markets. Report this page